“Can you supply carbon-neutral forgings?”

Three years ago, this question never came up. Today, we hear it weekly.

The steel industry produces 7% of global CO2 emissions. Forging adds another layer of energy consumption. Clients who ignored carbon footprint for decades now demand sustainability data with every quote.

Welcome to the green steel revolution. It’s not coming. It’s here.

After 30 years in forging supply, we’re watching the biggest transformation since duplex stainless steel. This article explains what green steel means, how decarbonization changes forging, and why sustainable sourcing will define the next decade of the steel industry.

Steel production is carbon-intensive. The traditional process burns coal to convert iron ore into steel. This releases massive CO2 volumes.

The numbers are stark.

That’s more than all passenger cars worldwide combined.

For forging customers in offshore, energy, and marine industries, this creates a problem. Their own decarbonization targets require supply chain emissions reduction. Steel forgings are a significant contributor.

Steel production emissions break down:

Traditional blast furnaces use coking coal for both heat and chemical reduction. This locks in carbon emissions at the fundamental chemistry level.

Changing this requires changing the entire production process.

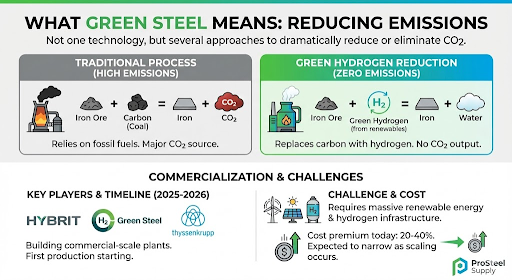

Green steel isn’t one technology. It’s several approaches to dramatically reduce or eliminate steel production emissions.

The most promising approach replaces carbon with green hydrogen as the reducing agent.

Traditional process: Iron ore + carbon (coal) = iron + CO2

Green hydrogen process: Iron ore + hydrogen = iron + water

No carbon input means no CO2 output.

The technology exists. HYBRIT in Sweden, H2 Green Steel, and Thyssenkrupp are building commercial-scale plants. First production starting 2025-2026.

The challenge: Green hydrogen must be produced using renewable electricity. This requires massive renewable energy capacity and hydrogen production infrastructure.

Cost premium today: 20-40% over traditional steel. Expected to narrow as production scales.

Electric arc furnaces (EAF) melt recycled scrap steel using electricity rather than coal.

Emissions reduction: 70-80% compared to blast furnace when powered by renewable electricity.

The advantage: Technology is proven. Many forges already use EAF steel. Switching to renewable power sources drops emissions immediately.

The limitation: Depends on scrap availability. Can’t produce all steel from recycled content alone. Quality control is harder with varied scrap inputs.

Retrofit existing blast furnaces with CO2 capture technology. Captured carbon is stored underground rather than released.

Emissions reduction: 80-90% if capture is effective.

The challenge: High capital cost. Energy penalty for capture process. Long-term storage questions.

Several pilot projects are operating. Commercial scale deployment starting 2026-2028.

Green steel affects more than just the steel mill. The entire forging supply chain must adapt.

Green steel production capacity is limited today. HYBRIT produces 100,000 tons annually. H2 Green Steel will add 5 million tons by 2030. Compare this to 1.9 billion tons global production.

For forging customers, this means:

Specifying green steel today means planning 18+ months ahead and accepting higher costs.

Proving steel is actually “green” requires documentation throughout the supply chain.

What customers need:

This documentation is new for the steel industry. Standards are still developing. Forging suppliers must implement systems to track and document green steel through production.

Green hydrogen reduction works well for carbon steel. Alloy steels and stainless steels are more complex.

Duplex and superduplex stainless require nickel, chromium, and molybdenum additions. These alloys aren’t produced via hydrogen reduction yet. They’re melted in electric furnaces using recycled content and virgin alloys.

For offshore forgings:

Green steel costs more. How much more depends on production method and carbon price assumptions.

These premiums reflect:

Cost premiums will narrow as:

Industry projections: Cost parity between green and traditional steel by 2035-2040, assuming carbon pricing of €80-100 per ton CO2.

For forging customers, green steel is expensive today but will become competitive within 10-15 years.

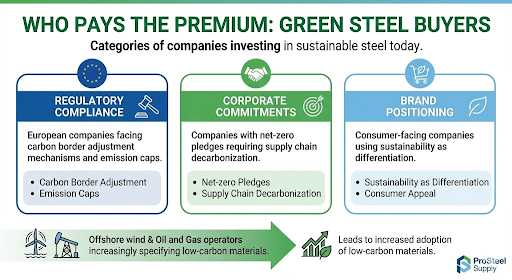

Today, green steel buyers fall into categories:

Offshore wind projects increasingly specify low-carbon materials. Oil and gas operators are beginning to include carbon footprint in procurement criteria.

The market is shifting from “nice to have” to “required.”

The steel industry transformation is happening at different speeds globally.

European Union carbon pricing and regulatory pressure drive the fastest transition.

Major projects:

European steel will be predominantly low-carbon by 2035 based on current trajectories.

China produces 50% of global steel. Decarbonization here determines global impact.

Chinese government committed to peak emissions by 2030, carbon neutrality by 2060. Steel industry is priority sector.

Timeline: Significant deployment 2030+. Full transition 2050+.

For forging customers, regional differences create trade-offs:

Sourcing strategy depends on timeline, budget, and certification requirements.

Green steel transition is happening whether individual customers act or not. The question is whether to lead, follow, or resist.

Understand current supply chain emissions. Steel forgings are typically significant contributors.

This assessment determines where green steel makes biggest impact.

Forging suppliers are at different stages of green steel readiness.

Questions to ask:

Early dialogue helps you understand options and constraints.

Green steel forgings require more planning than traditional procurement.

Timeline considerations:

Build 6-12 months additional buffer into project schedules for green steel components.

The race isn’t stopping at 15 MW. Prototype 20+ MW turbines are already in development.

Siemens Gamesa, Vestas, and GE are developing 18-22 MW offshore turbines. Expected commercial deployment 2027-2030.

These will require:

This pushes forging capability to its absolute limits.

Can the forging industry keep up? Current evidence is mixed.

Positive signs: Chinese forges are investing in 15+ meter ring rolling capacity.

Concerning signs: European capacity remains constrained. Lead times for large forgings are extending.

The industry is in a race between turbine scaling and forging capacity growth. Right now, turbines are winning.

After 30 years in forging supply, we’re positioned uniquely for the offshore wind revolution.

Our Large-diameter network:

We work with the 8 forges globally that can produce 8+ meter rings to offshore specifications. We know their capacity, their booking status, and their capabilities.

When wind projects need large forgings, we know which forge has availability and which specification requirements match their qualifications.

Early planning support:

We help wind projects plan forging procurement 18+ months ahead. We reserve capacity. We lock material allocations. We coordinate inspector schedules.

This forward planning prevents the bottlenecks that delay projects.

Quality and delivery assurance:

We manage the complete supply chain. Material procurement. Forge production. Heat treatment. Third-party inspection. Machining. Transportation to site.

Wind projects get one contact point. We manage the complexity.

After 30 years coordinating forging supply chains, we’re building green steel capabilities.

Our Green Steel Network:

We work with European forges accessing green hydrogen steel and EAF production with renewable power. We track which forges have green steel capability, what grades are available, and what lead times apply.

When you need low-carbon forgings, we know which suppliers can deliver.

Documentation and Traceability:

We’re implementing systems to track and document carbon footprint through the supply chain. Steel mill certificates. Production energy sources. Transportation emissions. Complete Scope 3 data for your reporting.

Transition Planning:

We help clients plan their green steel transition. Which components to prioritize. What timeline is realistic. How to balance cost, availability, and carbon reduction.

This isn’t a one-time switch. It’s a multi-year transition requiring strategic planning.

Green steel is transforming the steel industry. Production methods are changing. Supply chains are adapting. Costs are premium today but falling.

For forging customers, this creates both challenges and opportunities.

Challenges: Limited availability, longer lead times, cost premiums, documentation requirements.

Opportunities: Early mover advantage, supply chain decarbonization, future-proofing against carbon pricing.

The transition is inevitable. European carbon border mechanisms and corporate net-zero commitments ensure it. The question isn’t whether to adopt green steel, but when and how.

Need help navigating green steel for your forging requirements? ProSteel Supply tracks the evolving landscape daily. We’ll show you what’s available today, what’s coming tomorrow, and how to build sustainable sourcing into your supply chain.

Contact us for green steel guidance. Because in the steel industry, the transition has started.

Download our whitepaper and gain practical insights into materials, quality, and supply reliability.