“We have a problem. Our forge in Germany just called. They’re booked solid for the next nine months.”

The project manager’s voice was calm. Too calm.

This was week three of a €40 million offshore installation project. The forgings were on the critical path. No forgings meant no manifolds. No manifolds meant no subsea trees. No subsea trees meant the vessel sat idle at €800,000 per day.

Welcome to supply chain planning in forging. One bottleneck can cost millions.

After three decades coordinating forging supply chains for offshore and energy projects, we’ve seen what works and what fails. This article breaks down the lessons learned, the mistakes that cost projects, and the sourcing strategy that keeps critical components flowing.

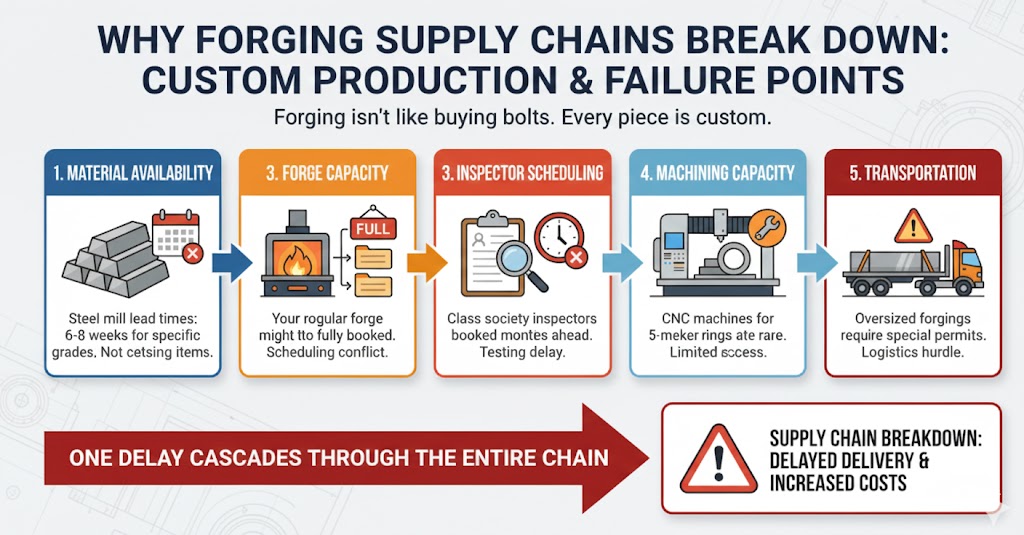

Forging isn’t like buying bolts. You can’t order from a catalog and expect delivery in two weeks.

Every forging is a custom production run. Material must be sourced. Furnaces must be scheduled. Heat treatment takes time. Testing requires inspector availability. Machining follows strict sequences.

The supply chain has multiple failure points:

One delay cascades through the entire chain.

Most projects start with a single source. One forge. One supplier. One relationship.

This works fine until it doesn’t.

Real example: A North Sea operator sourced duplex manifolds from the same German forge for 15 years. Excellent quality. Reliable delivery. Strong relationship.

Then the forge was acquired. New management restructured operations. Lead times doubled. Pricing increased 35%. The forge’s priorities shifted to automotive and aerospace customers.

The operator had no backup. No alternative suppliers qualified. No relationships with other forges.

Result: Six-month project delay while they qualified a new forge. €12 million in idle vessel costs and contract penalties.

The lesson: Single sourcing feels efficient until it becomes your biggest risk.

Dual sourcing means maintaining relationships with at least two qualified suppliers for critical components.

Not splitting every order 50/50. Not doubling your procurement workload. Strategic backup capacity.

Primary supplier: Handles 70-80% of your volume. Gets your standard orders. Builds deep knowledge of your requirements.

Secondary supplier: Handles 20-30% of volume. Maintains capability and relationship. Provides surge capacity and backup.

Both suppliers stay qualified. Both know your specifications. Both have proven delivery.

When your primary forge hits capacity, your secondary forge has availability. When material shortages hit, you have two sources competing for steel allocations. When inspector schedules slip, you have flexibility to shift production.

Dual sourcing costs more upfront. You’re qualifying two forges instead of one. You’re maintaining two relationships.

But compare that cost to project delays:

The math works. Every experienced procurement team knows this

Vendor management in forging isn’t about squeezing the lowest price. It’s about ensuring performance when it matters.

Regular capacity reviews: Quarterly calls with forges to understand booking status, planned shutdowns, equipment investments.

Performance tracking: On-time delivery rates, quality metrics, responsiveness to technical questions.

Relationship building: Site visits, technical exchanges, understanding their challenges.

Early warning systems: Knowing about capacity constraints before they become your problem.

Good vendor management creates information flow in both directions.

You tell your forges: Upcoming project pipeline, likely volumes, specification trends, timeline criticality.

Your forges tell you: Capacity availability, material lead times, technical capabilities, potential bottlenecks.

This information exchange is worth more than a 5% price discount.

Real example: Our relationship with an Italian forge gave us early warning that nickel prices were spiking and supply was tightening. We locked in material allocations three months before the broader market shortage hit. Our clients got their 6Mo forgings on schedule. Competitors waited six months.

That’s vendor management delivering value.

Forging supply chains require long planning horizons. Waiting until you need the parts is too late.

18 months out: Identify critical long-lead forgings. Start forge capacity discussions.

12 months out: Lock forge slots. Commit material specifications. Book inspector schedules.

9 months out: Confirm material procurement. Finalize drawings. Place purchase orders.

6 months out: Material arrives at forge. Production begins. Weekly progress tracking.

3 months out: Testing and certification. Final machining. Shipping coordination.

This timeline assumes everything goes smoothly. Add 20% buffer for reality.

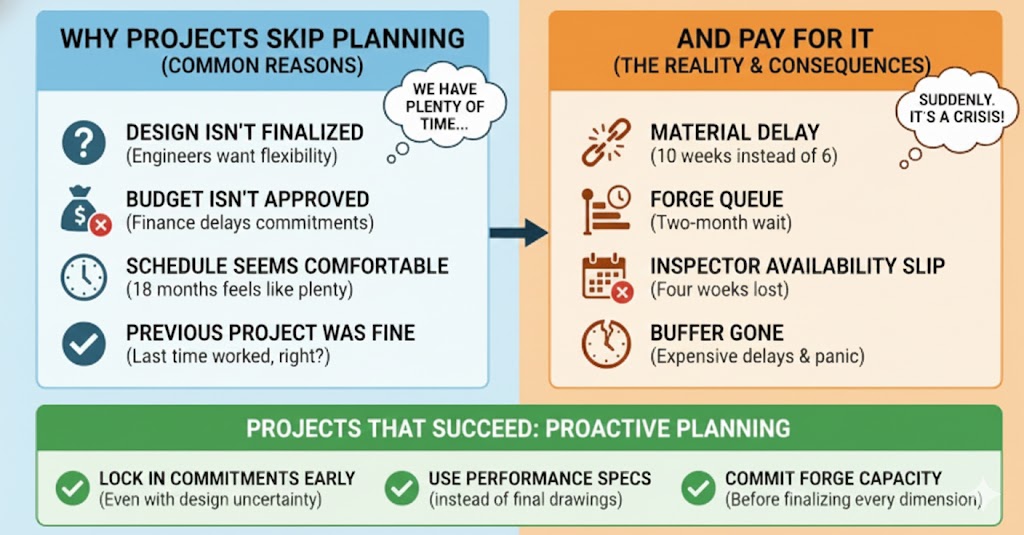

Projects skip proper supply chain planning for predictable reasons:

Then reality hits. Material takes 10 weeks instead of 6. The forge has a two-month queue. Inspector availability slips by four weeks. Suddenly your 18-month buffer is gone.

Projects that succeed lock in supply chain commitments early, even with design uncertainty. They use performance specifications instead of final drawings. They commit forge capacity before finalizing every dimension.

A resilient sourcing strategy balances cost, quality, delivery, and risk.

Don’t source all critical forgings from one region.

European forges: High quality, NORSOK qualified, but limited capacity and high costs.

Asian forges: Lower costs, increasing quality, but longer logistics and some certification gaps.

Having suppliers in both regions provides flexibility when regional disruptions occur.

Real example: COVID-19 hit Europe hard in early 2020. Italian and German forges shut down for weeks. Asian forges were already ramping back up. Projects with Asian backup suppliers maintained continuity. Single-source European projects faced 3-6 month delays.

Know what each forge in your network can do.

When a requirement comes in, you know immediately which forge fits best. You’re not scrambling to find capability under time pressure.

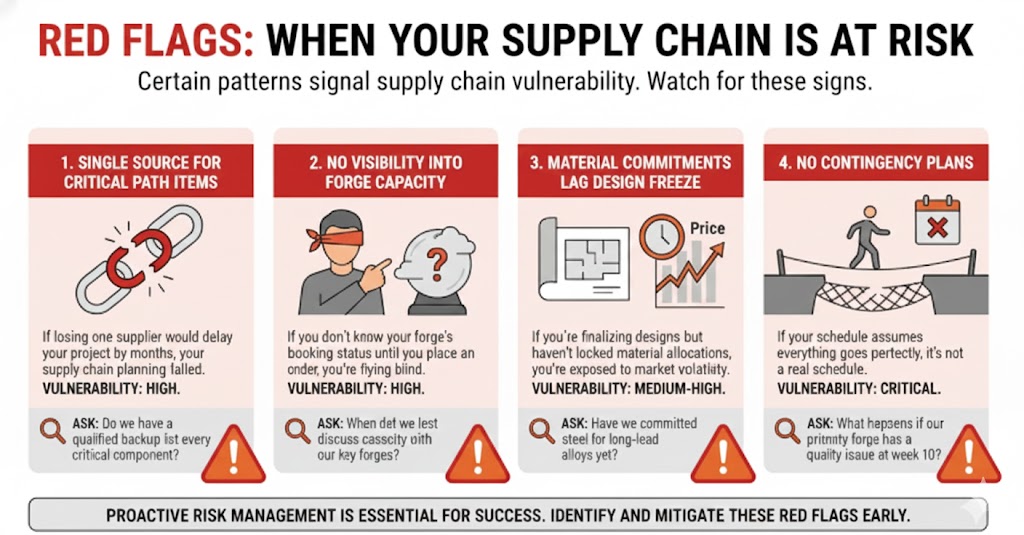

Certain patterns signal supply chain vulnerability.

Single source for critical path items

If losing one supplier would delay your project by months, your supply chain planning failed.

Ask: Do we have a qualified backup for every critical component?

No visibility into forge capacity

If you don’t know your forge’s booking status until you place an order, you’re flying blind.

Ask: When did we last discuss capacity with our key forges?

Material commitments lag design freeze

If you’re finalizing designs but haven’t locked material allocations, you’re exposed to market volatility.

Ask: Have we committed steel for long-lead alloys yet?

No contingency plans

If your schedule assumes everything goes perfectly, it’s not a real schedule.

Ask: What happens if our primary forge has a quality issue at week 10?

After coordinating hundreds of offshore and energy projects, we see clear patterns.

Experienced buyers reserve forge capacity before final designs. They use performance specifications to secure slots, then finalize details later.

This costs nothing (capacity reservations are typically free or low-cost) and provides schedule insurance.

When project volume drops, inexperienced buyers disappear. Experienced buyers maintain contact, place small orders, keep relationships warm.

When the next urgent project arrives, they have suppliers ready to respond.

Experienced buyers know that the cheapest quote rarely delivers the best outcome. They’re willing to pay 5-10% premiums for suppliers with proven delivery performance.

One avoided delay pays for years of slightly higher pricing.

After 30 years coordinating forging supply chains, we built the network that projects need.

Our forge network:

We maintain relationships with 25+ qualified forges across Europe and Asia. Carbon steel to exotic alloys. Small rings to 8-meter diameters. NORSOK qualified to standard industrial grades.

When you need a forging, we know which three forges have capability and availability today.

Dual sourcing built in:

Our network provides automatic dual sourcing. We don’t rely on one forge for any critical component. If our primary source hits capacity, we have qualified alternatives ready.

You get the resilience of dual sourcing without managing multiple relationships yourself.

Supply chain planning support:

We track forge capacity across our network. We know material lead times for every grade. We coordinate inspector schedules before they become bottlenecks.

When you tell us your project timeline, we build backwards from your need-by date. We flag risks early. We lock commitments when it matters.

Vendor management you don’t have to do:

We visit forges quarterly. We track performance. We maintain relationships during slow periods. We negotiate better terms through volume across multiple clients.

You get the benefits of strong vendor management without the overhead.

Supply chain resilience in forging isn’t about having the cheapest supplier. It’s about having supply when you need it.

Yes, dual sourcing costs more than single sourcing. Yes, early supply chain planning requires commitment before designs are final. Yes, vendor management takes time and attention.

But these costs are tiny compared to project delays. One avoided bottleneck pays for years of resilient sourcing strategy.

The key is building resilience before you need it. When the crisis hits, it’s too late to qualify backup forges or lock material allocations.

Need help building supply chain resilience for your forging requirements? ProSteel Supply coordinates complex forging supply chains daily. We’ll show you which suppliers fit your needs, what backup capacity exists, and how to structure commitments that protect your schedule.

Contact us for supply chain planning support. Because in offshore and energy projects, the supply chain that fails costs more than the supply chain that works.

Download our whitepaper and gain practical insights into materials, quality, and supply reliability.