“We need a ring. Eight and a half meters diameter. Duplex steel. NORSOK certified. Can you make it?”

Five years ago, the answer was maybe. Three forges in the world had equipment large enough. Lead time was 12 months. Price was astronomical.

Today, that same ring is standard production. Lead time dropped to 20 weeks. Price fell 40%. And the next question is already here: “What about 12 meters?”

Welcome to the offshore wind revolution. Turbines are growing faster than the supply chain can keep up. The forgings that seemed impossible in 2019 are routine in 2025. And the race isn’t slowing down.

After three decades supplying forgings to energy projects, we’re watching the fastest transformation we’ve ever seen. This article explains what’s driving it, what it means for forging production, and why the next five years will make the last five look slow.

Offshore wind economics are simple. Bigger turbines generate more power. More power per turbine means fewer turbines needed. Fewer turbines means lower installation costs.

The math drives relentless growth.

Each generation requires larger components. Larger bearings. Larger main shafts. Larger tower sections. Larger foundation connections.

Forgings scale with turbine size.

Installing offshore wind turbines is expensive. Specialized vessels cost €500,000-1,000,000 per day. Weather windows are limited. Every day at sea costs money.

Fewer, larger turbines mean fewer installations. A 1,000 MW wind farm needs:

Same power output. Dramatically different installation costs.

This drives the race to larger capacity. And larger capacity demands larger forgings.

Bigger turbines don’t just scale linearly. They create new technical challenges.

A 15 MW turbine requires:

These aren’t incremental increases. They’re step changes in forging capability.

Larger forgings mean heavier forgings. An 8-meter duplex ring weighs 12-15 tons. A 10-meter ring weighs 20+ tons.

This creates challenges:

Every step gets harder as size increases.

Offshore platforms demand corrosion resistance. Wind turbine forgings spend decades exposed to salt spray and temperature cycles.

Material requirements:

These materials are harder to forge, harder to machine, and require specialized heat treatment. Larger sizes amplify every difficulty.

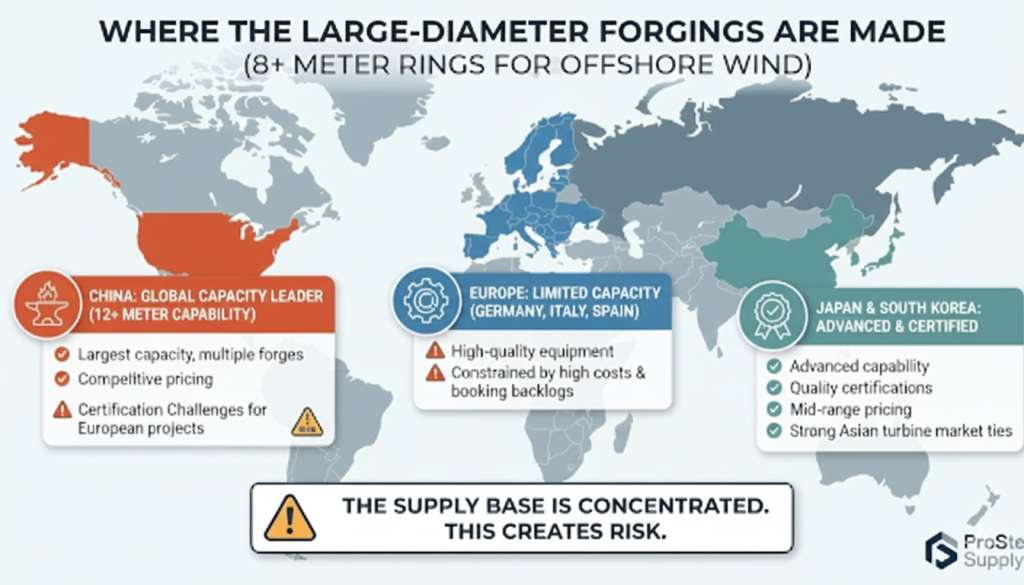

Not many forges can produce 8+ meter diameter rings. Even fewer can do it to offshore wind specifications.

China: Largest ring rolling capacity globally. Multiple forges with 12+ meter capability. Competitive pricing but certification challenges for European wind projects.

Europe: Limited large-diameter capacity. Germany, Italy, Spain have equipment but constrained by high costs and booking backlogs.

Japan and South Korea: Advanced capability with quality certifications. Mid-range on pricing. Strong relationships with Asian turbine manufacturers.

The supply base is concentrated. This creates risk.

When multiple large wind projects launch simultaneously, forge capacity becomes the limiting factor.

Real example: 2023 saw five major North Sea wind farms enter construction phase. All specified 15 MW turbines. All needed large-diameter duplex rings. European forges were booked 18 months out. Asian forges had capacity but faced certification questions.

Result: Project delays, premium pricing, and frantic qualification of new forge sources.

The industry is adding capacity, but demand is growing faster.

Monopile installation drives demand for the absolute largest forgings. Not for the turbines themselves, but for the installation tooling.

A monopile is a massive steel tube driven into the seabed to support the turbine. Diameters now reach 10-12 meters. Length up to 100 meters. Weight up to 2,000 tons.

Installing them requires specialized equipment:

These installation tools are custom for each wind farm. Monopile diameters vary by site conditions. Tools must be manufactured for each project.

Offshore platforms that install monopiles are among the most expensive vessels in the world. Daily rates from €800,000-1,500,000.

Having the wrong tools or tool failures creates massive costs. A broken gripper tool that forces a vessel back to port can cost €5-10 million in delay and vessel standby time.

This makes forging quality and delivery reliability critical. Cheap forgings that fail under load are catastrophically expensive. Late deliveries that miss vessel mobilization windows can delay entire wind projects.

The forgings are expensive. The consequences of failure are far more expensive.

Producing 8-10 meter diameter forgings to offshore wind specifications isn’t just scaled-up production. New challenges emerge.

Heat treating a 10-meter ring requires heating 20+ tons of steel to 1,050°C, holding for hours, then quenching uniformly.

The challenge: Temperature gradients between surface and core. Uneven cooling creates internal stress. Stress creates distortion and cracking risk.

Solution requires: Specialized large furnaces, controlled atmosphere, precise temperature monitoring, calculated cooling rates.

Only a handful of forges worldwide have this capability.

Final machining of large wind turbine forgings requires holding tolerances of ±0.5mm on components that are 10 meters diameter and weigh 20 tons.

The challenge: Deflection under cutting forces. Thermal expansion during machining. Setup and fixturing of massive components.

Solution requires: Specialized large CNC equipment, thermal compensation programming, multi-day machining operations.

Machining capacity is as much a bottleneck as forging capacity.

Wind projects operate on tight schedules with massive financial penalties for delays. What they need from forging suppliers has changed.

Wind projects now lock forge capacity 18-24 months before production. Waiting for final designs is too late.

Smart developers:

This forward planning separates projects that deliver on time from projects that scramble.

One forging failure on an offshore platform can cost €10+ million in vessel standby, replacement parts, and schedule delay.

Wind projects demand:

Price matters. Quality matters more.

Turbine designs evolve during project development. Forging suppliers must accommodate changes without destroying schedules.

This requires:

The suppliers who win wind projects are those who solve problems, not those who cite contract terms

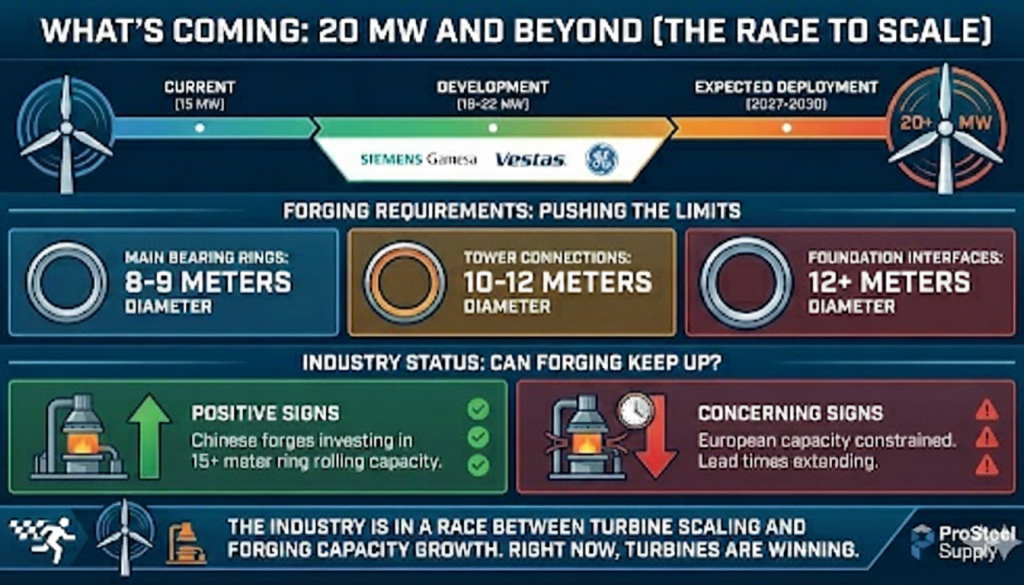

The race isn’t stopping at 15 MW. Prototype 20+ MW turbines are already in development.

Siemens Gamesa, Vestas, and GE are developing 18-22 MW offshore turbines. Expected commercial deployment 2027-2030.

These will require:

This pushes forging capability to its absolute limits.

Can the forging industry keep up? Current evidence is mixed.

Positive signs: Chinese forges are investing in 15+ meter ring rolling capacity.

Concerning signs: European capacity remains constrained. Lead times for large forgings are extending.

The industry is in a race between turbine scaling and forging capacity growth. Right now, turbines are winning.

After 30 years in forging supply, we’re positioned uniquely for the offshore wind revolution.

Our Large-diameter network:

We work with the 8 forges globally that can produce 8+ meter rings to offshore specifications. We know their capacity, their booking status, and their capabilities.

When wind projects need large forgings, we know which forge has availability and which specification requirements match their qualifications.

Early planning support:

We help wind projects plan forging procurement 18+ months ahead. We reserve capacity. We lock material allocations. We coordinate inspector schedules.

This forward planning prevents the bottlenecks that delay projects.

Quality and delivery assurance:

We manage the complete supply chain. Material procurement. Forge production. Heat treatment. Third-party inspection. Machining. Transportation to site.

Wind projects get one contact point. We manage the complexity.

The offshore wind revolution is driving the largest forgings ever produced in volume. 15 MW turbines are standard today. 20 MW turbines are coming tomorrow.

This creates opportunities and challenges. Projects that plan early and work with capable suppliers deliver on time. Projects that wait and hope face delays and premium costs.

The forging supply chain is stretched. Capacity is constrained. Lead times are long. Quality requirements are strict.

Success requires early planning, strong supplier relationships, and experience navigating a complex global supply chain.

Need large-diameter forgings for wind projects? ProSteel Supply coordinates offshore wind forging supply daily. We’ll show you what capacity exists, what lead times are realistic, and how to structure procurement that protects your project schedule.

Contact us for wind forging guidance. Because in offshore platforms, the forgings that arrive late cost more than the forgings that arrive on time.

Download our whitepaper and gain practical insights into materials, quality, and supply reliability.